Services Available

Our Services

Mobile Money Transfer

Connect Instantly, Pay Less: Send Money Across Africa! Seamless transfers directly to mobile wallets with instant delivery and industry-leading low fees.

Instant transfers to mobile wallets Low transaction fees Real-time tracking Comprehensive mobile options

Mobile Wallet Transfer

Empower your finances with our seamless wallet-to-wallet transfers. Send money directly to digital wallets across Africa with lightning-fast processing and minimal fees.

Wallet-to-wallet transfers Competitive exchange rates Fast processing times T-plus integration

Bank Transfer

Secure, reliable bank transfers that move with the speed of digital. Send money directly to bank accounts across Africa with instant delivery and minimal transaction costs.

Direct bank account deposits Multiple banking partners No hidden fees Fast transaction processing

Cash Pickup

Convenient cash pickup service with an extensive network of agents. Offering flexible pickup options to ensure your money reaches its destination safely and quickly.

Extensive agent network Flexible pickup options Same-day availability Competitive rates

Humanitarian Money Transfer (HMT)

Specialized services designed for NGOs and humanitarian organizations operating in crisis regions. Distribute funds efficiently, securely, and with reduced fees for maximum impact.

Bulk payment processing Reduced fees for humanitarian work Dedicated support team Compliance with international regulations

Business Payment Solutions

Comprehensive payment infrastructure for businesses of all sizes operating across Africa. Streamline operations with efficient payment systems tailored to your business needs.

Bulk payment processing Payroll services Vendor payments Cross-border business transfers

Mobile Money Transfer

Seamless Transfers

Instantly send money directly to mobile wallets across Africa with minimal fees.

Comprehensive Mobile Options

Wide range of mobile money services supporting major carriers across Africa.

Real-time Tracking

Monitor your transfer in real-time from start to finish.

Low Transaction Fees

Enjoy competitive rates and low fees on all your transactions.

EVC-PLUS

M-PESA

MTN

AIRTEL

ORANGE

ZAAD

SAHAL

VODACOM

AFRICELL

Our Core Values

Trust & Reliability

We build trust through consistent, reliable service and transparent operations, ensuring our customers can depend on us for their financial needs.

Security & Compliance

We prioritize the security of every transaction and adhere to the highest regulatory standards to protect our customers and their money.

Speed & Efficiency

We understand the urgency of money transfers and strive to deliver fast, efficient service without compromising on quality or security.

Community Focus

We're deeply connected to the communities we serve and committed to making a positive impact through our services and community initiatives.

Global Perspective

We embrace diversity and maintain a global outlook, adapting our services to meet the unique needs of customers across different regions and cultures.

Customer-Centric

We put our customers at the heart of everything we do, listening to their needs and continuously improving our services to exceed their expectations.

Our Global Presence

Our direct presence spans across continents, ensuring reliable service wherever you are.

Our strategic partnerships extend our reach to even more countries around the world.

Digital Solutions

Partnership Products

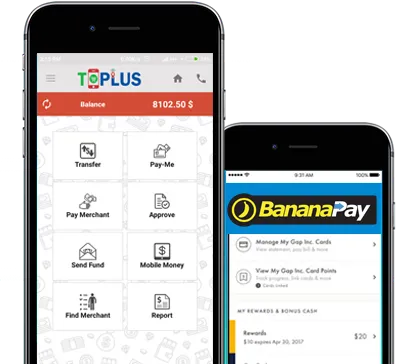

T-Plus

Mobile Wallet

Somalia's first mobile wallet for seamless money transfers and payments.

Send & Request Money

Pay Merchants

Mobile Money Integration

Mobile App

Transfer Complete

$250 Received